Soviet political starvation of Ukraine:

“With starvation will come cannibalism. There came a moment in Ukraine when there was little or no grain, and the only meat was human. A black market arose in human flesh; human meat may even have entered the official economy. The police investigated anyone selling meat, and state authorities kept a close eye on slaughterhouses and butcher shops. A young communist in the Kharkiv region reported to his superiors that he could make a meat quota, but only by using human beings. In the villages smoke coming from a cottage chimney was a suspicious sign, since it tended to mean that cannibals were eating a kill or that families were roasting one of their members.”

Excerpt From: Timothy Snyder. “Bloodlands: Europe Between Hitler and Stalin”. Apple Books.

Flesh baquests at the height of the Cultural Revolution

“In 1968 a geography instructor named Wu Shufang was beaten to death by students at Wuxuan Middle School. The body was carried to the flat stones of the Qian river where another teacher was forced at gunpoint to rip out the heart and liver. Back at the school the pupils barbecued and consumed the organs.”

‘Flesh banquets’ of China’s Cultural Revolution remain unspoken, 50 years on

Organized cannibalism in the 1845 HMS Erebus expedition looking for the North-West passage:

“Both archaeological evidence and reports from Inuit locals gathered by the many explorers sent to rescue the expedition indicate that the crew fragmented, moved south, and cannibalism ensued. In one report, an Inuit band encountered one of the crew’s parties. They gave the hungry men some seal meat but quickly departed when they noticed the crew transporting human limbs. Remains of the expedition have been located on several different parts of the island. There is also a rumor, never confirmed, that Crozier made it far enough south that he fell in with the Chippewa, where he lived out his days hiding from the shame of sustained and organized cannibalism.2”

Excerpt From: Joseph Henrich. “The Secret of Our Success: How Culture Is Driving Human Evolution, Domesticating Our Species, and Making Us Smarter”. Apple Books.

(side note, HMS Erebus by Simmons I am told is a fine horror book)

Humans are one of the biggest biomasses on earth, cannibalism is inevitable in the occasion os some future catclysm ? https://en.wikipedia.org/wiki/Biomass_(ecology)

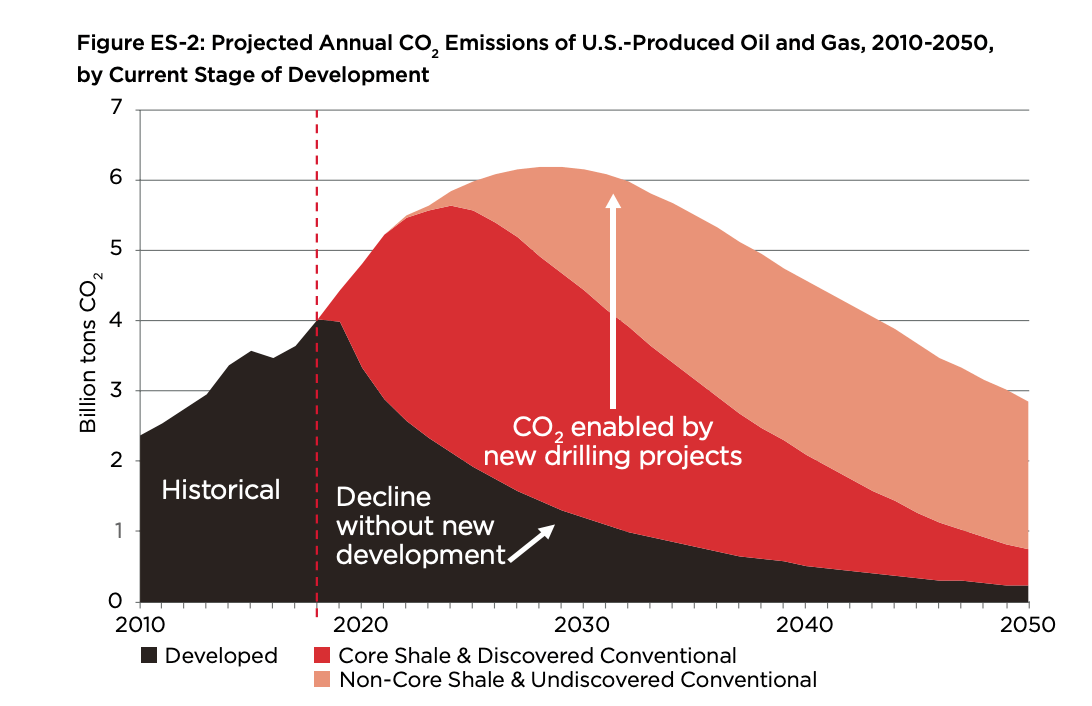

US dominance in oil makes impossible to reduce emissions and meet green targets

US dominance in oil makes impossible to reduce emissions and meet green targets