a mathematicians put it very simply, where an economist sees productivity a physicist sees energy https://twitter.com/ole_b_peters/status/1517433580267487232

replies in the 3d are also interesting, the economy makes a better use of energy since the oil crisis, will it make a difference. Therphysicist might be unimpressed and remain skeptical.

Here a Lotke wheel is introduced and supports that physicist’s skeptiscism, it will be hard to keep growing if energy production does not grow herself. We grow the wheel and accelerate the circulation by adding more energy in the process. From this paper:

Lotka’s wheel and the long arm of history: how does the distant past determine today’s global rate of energy consumption?

In this approach future GDP is also caused by the cumulative GDP, all its history and, while the enrgy efficiency is clearly going up, the relationship between current and cumulative GDP remain steady

This is beacfuse cumulated GDP (which is W) captures all the wealth amassed over time, not just the one that gets monetised and depreciates quickly halving every 3,5 minutes. Greek fig trees might be dead 2,000 years but a culture of the fig tree remains owing to the ancient greeks

Does this model captures societal resistance or hysteresis to change ? It rather captures a “dark matter” of knowledge, insituttions, belifs a practices that shape the hidden metabolism of the world, beyond the markets. The relationship W/E stayed constant over 50 years in which 2/3rd of the wealth was created so, if we expect to stay constant as it is hard to change, continued growth will require growing.

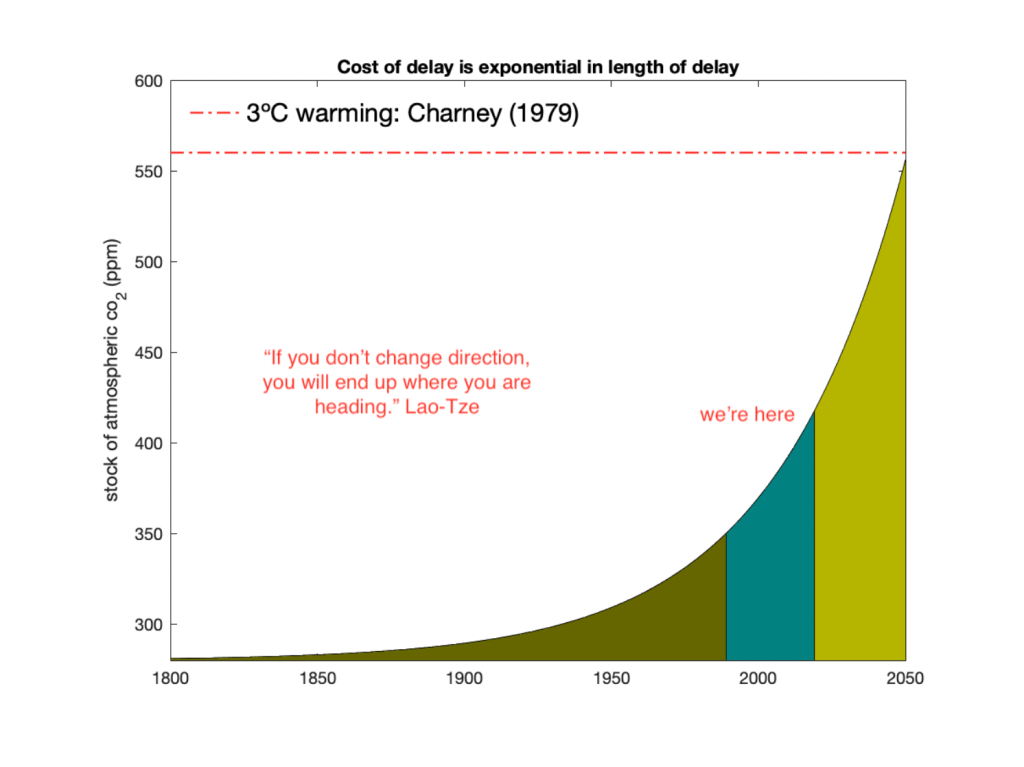

Therefore “Even if world GDP growth falls to zero from its recent levels close to 3 % yr−1, long-term decadal-scale growth in resource demands and waste production will continue to accelerate. It is only by collapsing the historic accumulation of wealth we enjoy today, effectively by shrinking and slowing Lotka’s wheel, that our resource demands and waste production will decline” and this could happen via hyperinflation. But this is not doomism, is just a n implication of the model.

Approached from the opposite side it means that, as energy consumption will keep growing, decarbonization will have to proceed faster in order to decouple effectively growth from CO2, while growth and energy seems not easy to decouple. Unless something very deep